Invoice templates for consultants

Discover vcita consultants templates that make you invoice like a pro!

Or start to send unlimited invoices and accept online payments with vcita (Try 14 days free trial)

Discover vcita consultants templates that make you invoice like a pro!

Or start to send unlimited invoices and accept online payments with vcita (Try 14 days free trial)

All templates come in Excel and Word fomat

For full list of blank invoice templates click here

Download vcita free invoice templates

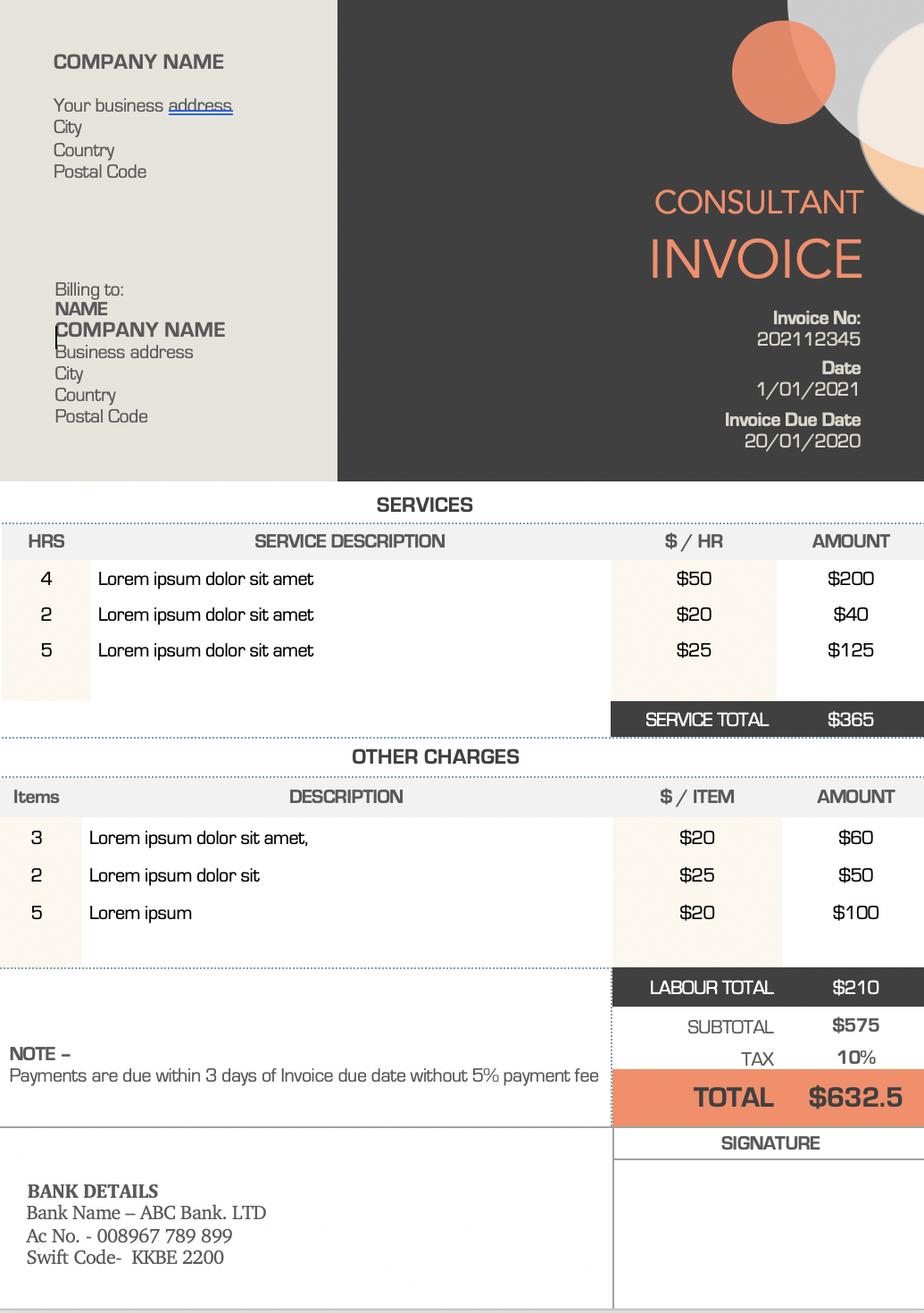

Designed for professional consultants

This is a bill and documentation which is sent by a consultant to their client indicating that work is complete and payment is due, this type of invoice contains details about the products that were provided or services that were rendered. It presents the overall cost and can furthermore be used for internal accounting.

Every invoice needs to have a specific identification number. This particular element can be made up of numbers only or be a combination of digits and letters.

This is the date when the invoice was officially issued to the customer.

This is the consultant company that provided goods or services to the client. Details such as the company name, registration number, address, and phone number are indicated here. If applicable, the VAT number is also indicated.

The client’s details are indicated here. Their name, address, and phone number are described in this part of the invoice.

The amount of time in hours or days should be included in the consultant invoice.

A description of the items provided or services rendered in the transaction is indicated in the invoice. If any goods were provided, their individual components are also described. Furthermore, the overall quantity, quality, and applicable units of measurement are indicated as well. In cases where products are purchased to complete the job, a breakdown should be given and billed to the client.

The specific type of legal tender that should be used in the transaction is indicated here.

If the products or services which you have provided to the client attract some taxes, these details are also indicated in the consultant invoice. A common type of tax is the Value Added Tax (VAT).

This is the total amount of goods provided or services rendered with the tax included. It is the amount which your client should pay.

This is the date by which the client should have paid the amount indicated in the invoice.

Any additional data about the transaction can be included here.

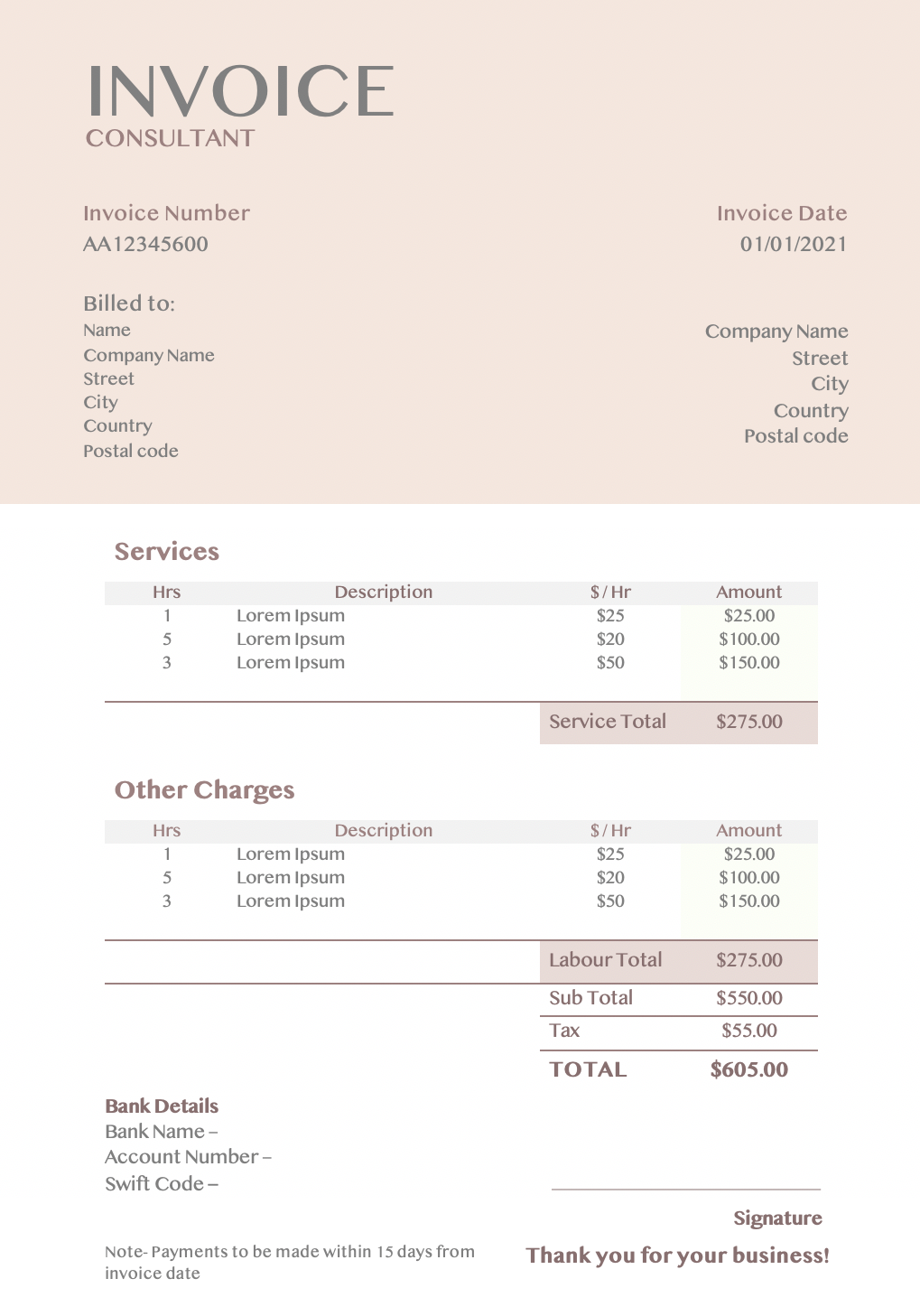

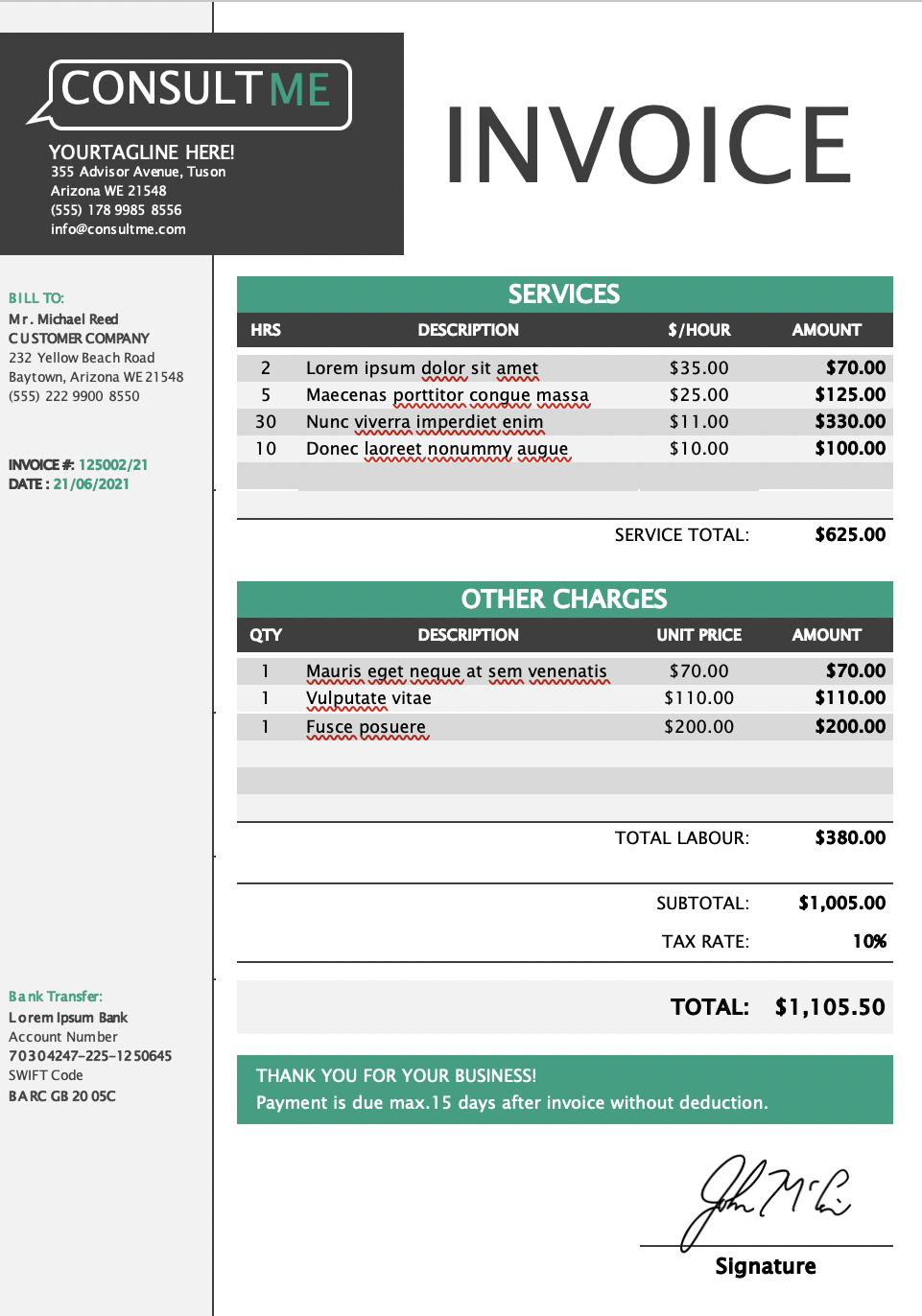

is straightforward and is used to bill for your consultancy services whenever a service is rendered. It will include a description of the service, the cost, accepted payment methods, and due date.

This is used to bill customers based on consultant’s worked hours on customers’ projects.

This is a form that captures all of the most important information about a business expense. It lets you determine how much you’ll reimburse a client for an expense they made using their own money.

is an invoice that is sent to the same customer at regular intervals, containing the same invoice details, it’s used to collect ongoing services.

also referred to as progress bill, is an accounting method where a consultant invoices a client in regular increments for a large project, billing for the percentage of the total project that has been completed to that point.

it’s the last invoice, usually sent after a project or order is completed, which includes the total amount of money that is still owed.

For this, you’ll be needing a timesheet invoice, an invoice is required once the customers’ project is completed.

A standard invoice is needed after the service is completed.

A standard invoice is required.

Interim invoices are required as the program lasts.

A standard invoice is required.

Here you’ll need a recurring invoice for a regular check of an investment plan.

A standard invoices are applicable.

Timesheet invoice is required.

Just like SEO consultants timesheet invoice is required.

Timesheet invoices are required as the charge occurs per hour.

An interim invoice is applicable.

Recurring invoices should be used to keep track of progress.

Generate estimates, invoices and accept payments online in one seamless flow – designed for consultants.

Copyright 2026 vcita Inc. All rights reserved.