As a small business owner, profit margins should be on your radar. Understanding your profit margins and how they compare to others in your industry is key to improving your bottom line and ensuring the long term financial health of your company.

While a good profit margin will vary based on your industry and the products or services you offer, increasing your profit margins comes down to optimizing your pricing strategy and reducing operating expenses. Ultimately, keeping an eye on profit margins will help set your small business up for success.

What is a profit margin and why does it matter for small business owners?

In brief, your profit margin is the amount that you’re taking in profit, after you pay your expenses. It’s not the same as income or revenue, because it takes your outgoings into consideration as well as the money you make. There are a few types of profit margins to consider:

- Gross profit margin measures the profitability of your products or services.

- Operating profit margin considers your operating expenses like rent, utilities and payroll.

- Net profit margin is the bottom line, factoring in all expenses and costs.

As a small business owner, your profit margin is one of the most important metrics to understand. Profit margin indicates your business’s financial health and ability to grow in the long run.

If your profit margin is too low, it means that your revenue isn’t covering costs and you need to improve profitability. Profit margins that are too high could be a sign that you’re missing opportunities for growth. The key is finding the right balance for your industry and business model.

Calculating different types of profit margins

As a small business owner, calculating your profit margin is key to understanding the financial health of your company. By tracking your profit margins over time and comparing them to industry averages, you can make strategic decisions to improve profitability. Here’s what you need to know to calculate the most important types of profit margin.

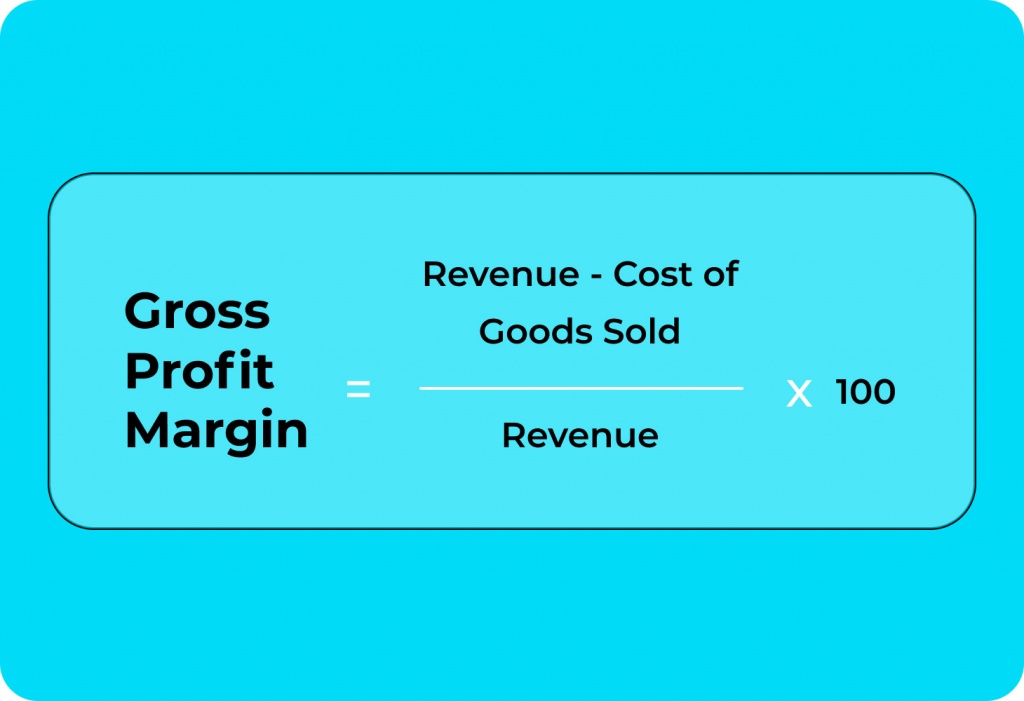

Gross profit margin

To calculate your gross profit margin, first you need to know your gross profit. This is calculated by taking your revenue and subtracting the cost of the goods or services you sold. Then you divide the gross profit margin by your total revenue, and multiply by 100. For example, if you earned $200,000 in revenue and spent $80,000 in costs, your gross profit is:

200,000-80,000= $120,000

Then divide $120,000 by $200,000, and multiply by 100:

$120,000 / $200,000 = 0.6

0.6 x 100 = 60%

A high gross profit margin means you have a good pricing strategy and control costs well. Typically, a good gross profit margin for a small service business is around 50-60%.

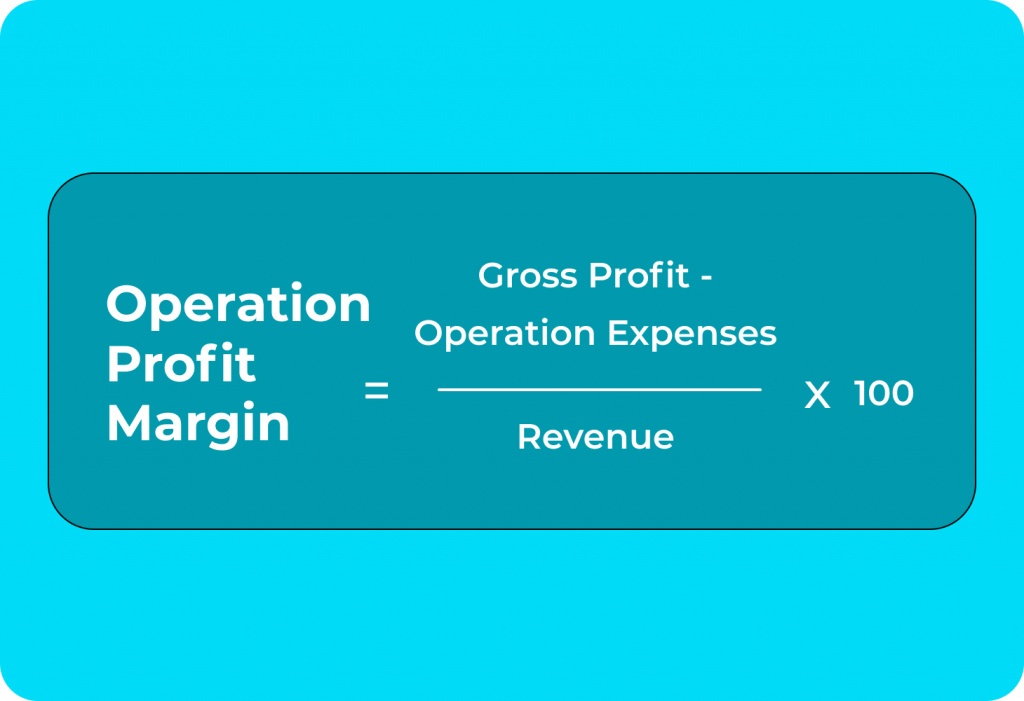

Operating profit margin

Your operating profit margin accounts for operating expenses like rent, utilities and staff costs. It’s calculated as operating profit / revenue x 100. To get your operating profit, subtract your operating expenses from your gross profit. For example, if your gross profit is $120,000, but you have $50,000 in operating expenses, your operating profit is:

120,000-50,000 = $70,000

Then divide $70,000 by your total revenue, which we said was $200,000:

70,000 / 200,000 = 0.35

0.35 x 100 = 35%

A good operating profit margin is 15-20%. This shows your core business is generating substantial income.

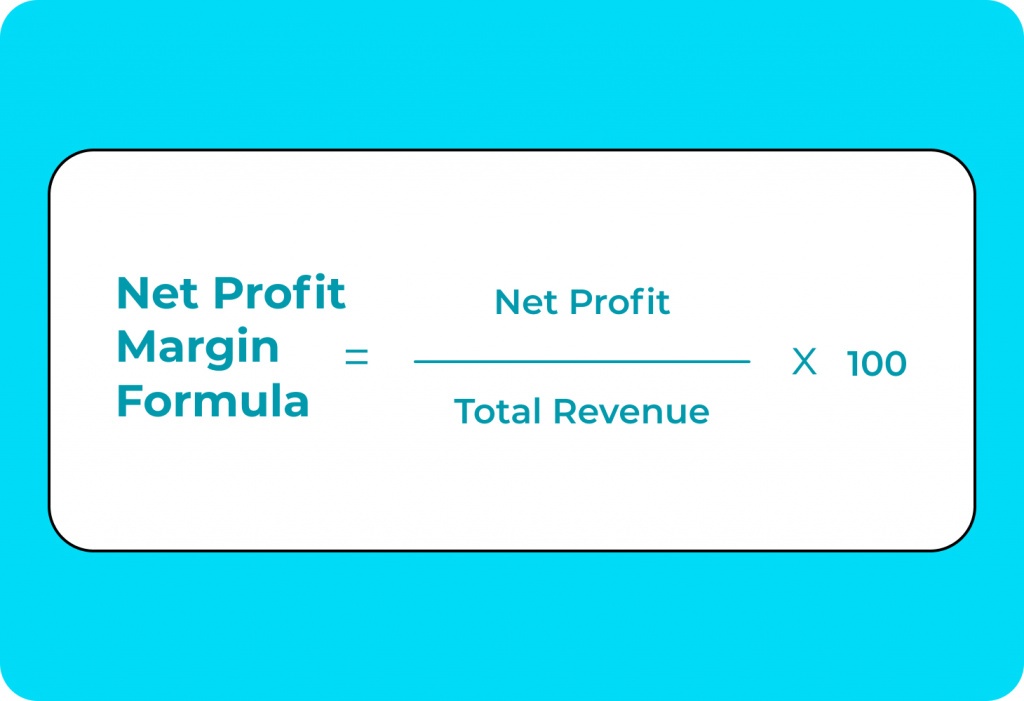

Net Profit Margin

Your net profit margin is your bottom line, meaning the funds you have left after all expenses are paid. It’s calculated as net income / revenue x 100. To arrive at your net income, first take your total revenue, then subtract all your costs. So if your revenue is $200,000 and your total costs come to $150,000, your net income is:

200,000-150,000 = $50,000

Now divide your net income by your total revenue, and multiply by 100. For example, if your net income is $50,000 and revenue is $200,000, your net profit margin is:

50,000 / 200,000 = 0.25

0.25 x 100 = 25%

Most small businesses target a net profit margin of at least 10-15%, for financial stability in the long term.

Average profit margins by industry for small businesses

It’s important to bear in mind that profit margins vary significantly by industry. The average net profit margin across all industries for small businesses is between 7-10%, but you need to account for the norms in your industry. For example:

- Real estate companies typically see higher profit margins, averaging around 17%

- Finance and insurance businesses tend to have the highest profit margins, averaging over 25%.

- Professional and technical services like law firms or IT consulting can range from 10% up to 20%.

- Retailers usually have lower profit margins, with the low average around 1.5% and reaching only as high as 4.5%.

Bear in mind that your location can also affect your profit margins. But if your net profit margin is well below your industry average, you may need to make changes to increase your profitability.

How to improve your profit margins

As a small business owner, you should analyze your profit margins regularly to determine areas for improvement. If your margins are on the lower end, examine your business processes to find ways to produce or deliver your products and services in less time with fewer resources. Making even small changes to improve your profit margins by a few percentage points can have a big impact on your business profits in the long run.

Here are a few ways you can increase your profit margins and improve your bottom line.

Adjust your pricing strategy

Your profit margins compare your revenue to your expenses, so if your revenue is high compared to your expenses, you’ll have good profit margins. One way to increase revenue is to raise your prices. Do some research on average profit margins in your industry and your competitors’ pricing to determine a fair price increase. You’ll want to find the sweet spot that maximizes revenue without sacrificing too many sales.

Reduce operating expenses

Lowering your operating expenses means more of your revenue will flow to your bottom line as net income, so look for ways to cut costs. Maybe you can renegotiate your office lease to get a lower rate, find ways to reduce utility usage, or buy supplies in bulk to lower costs. At the same time, improve efficiency. The more efficiently you operate, the lower your costs will be., so automate or streamline processes to save time and money. Improving employee productivity and performance can also help decrease labor costs.

Increase sales revenue

If you can’t cut costs, focus on selling more. Try expanding into new markets or customer segments, improving your marketing, or developing new products and services to drive sales growth. Maybe you’ll add a new offering to attract more customers, or create bundled packages of services or products that allow you to charge higher prices. You should also see what you can do to improve your marketing so you can drive more sales.

Monitoring and improving your profit margins takes work, but it’s worth it. Higher profit margins mean greater financial security and more opportunity for business growth.

Setting reasonable profit margin goals for long-term financial health

As a small business owner, setting reasonable profit margin goals is key to ensuring the long-term financial health of your company. Setting a clear target profit margin enables you to plan your pricing strategy, manage expenses, and make informed decisions that improve your bottom line.

It’s important to review financial reports regularly to see if you’re meeting your profit margin goals. Make sure your pricing still aligns with the value you provide to customers, and check if you need to renegotiate with vendors and suppliers to lower costs. Make adjustments to your pricing, marketing, or spending as needed to get your business profits to where they need to be for long-term success.

Profit margins are the foundation of your business success

As a small business owner, it’s important to track your profit margins regularly and look for ways to increase them over time. Understanding profit margins, setting reasonable goals, and monitoring your profit margins are the key to healthy profit margins, and healthy profit margins are essential for the financial wellbeing and growth of your company over the long run.