As a small business owner, you know how important it is to manage your cash flow. That’s why the invoice reconciliation process should be a key step in your accounting procedure, to ensure your records match up with suppliers and clients so you can spot problems like fraudulent activity or overdue payments.

This step-by-step guide to reconciling invoices will cover everything from matching purchase orders and invoice numbers to using accounting software. With the right invoice reconciliation process, you can avoid cash flow issues and keep your business finances on track. Let’s dive in!

What is invoice reconciliation?

Invoice reconciliation is the process of matching supplier invoices to purchase orders and payments. It’s an important accounting procedure that helps ensure that all invoices are accounted for and paid correctly.

Reconciling invoices involves reviewing the details on invoices and comparing them to the relevant purchase orders and receipts. This allows you to spot any errors or fraudulent activity early on. It also gives you an overview of how much you owe suppliers and the status of any open or overdue payments.

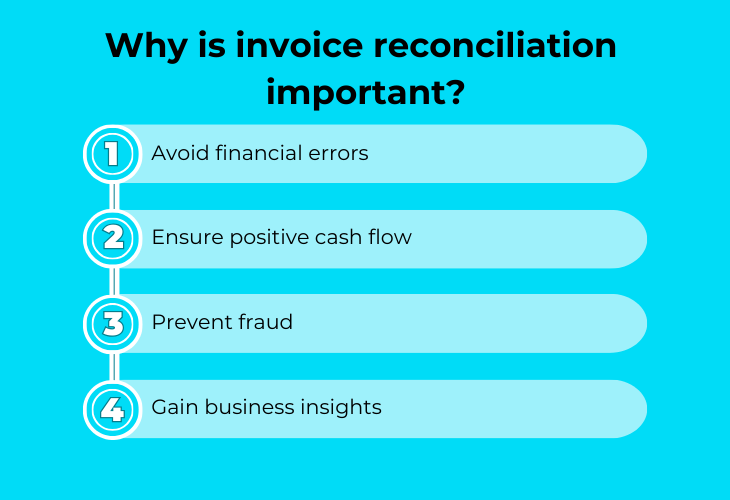

Why is invoice reconciliation important?

Invoice reconciliation is vital for effectively managing your finances, and contributes to your overall success. Here are a few reasons why reconciling invoices is important:

Avoid financial errors

Reconciling invoices helps weed out invoicing errors and ensures accurate vendor and supplier payments. By matching up purchase orders, supplier invoices, and payments, you can catch any discrepancies early on. This prevents overpayments, underpayments, or paying for something you did not receive.

Ensure positive cash flow

It helps you track cash flow and prevent payment issues. Comparing open invoices to payments helps you see what’s still owed and ensure vendors get paid on time according to your payment policy. This avoids late fees and damage to supplier relationships. Monitoring cash flow also helps determine if you have enough to cover expenses.

Prevent fraud

It deters fraudulent activity. Regularly reviewing accounting records and matching invoices to payments or purchase orders flags any suspicious invoices early. This makes it harder for fraud to slip through the cracks.

Gain business insights

It provides an accurate financial picture. By reconciling what’s owed, paid, and still due, you get a clear snapshot of your accounts payable and accounts receivable. This gives you insight into your financial position to make better business decisions. Performing regular invoice reconciliation will give you better financial control and insight into your accounts payable.

How does invoice reconciliation work?

Invoice reconciliation is the process of matching your outgoing invoices to payments received and your incoming supplier invoices to the items actually received. Reconciling invoices regularly is important to maintaining accurate accounting records and cash flow.

- Gather your invoices

First, collect all your unpaid outgoing invoices, incoming supplier invoices, bank statements, and purchase orders for the period you want to reconcile. It’s best to store them all together so that you don’t have to waste too much time tracking them down.

- Correlate with other sources

Then, compare each invoice to the relevant bank statement to find any payments received. Go through each invoice line by line, checking that the amounts, quantities, and prices match the agreed terms. Check that the total amount due on the invoice matches the amount recorded in your invoicing software, and note any discrepancies. On the accounts payable side, compare your supplier invoices to the actual items received and purchase orders to ensure you’re only paying for what was requested and delivered.

- Record reconciled invoices

Next, mark correct and completed invoices as paid. Look for any invoices that are past their due date to avoid late fees. Record each reconciled invoice in your books with the date it was reconciled.

- Follow up on unpaid invoices

For any unpaid invoices, follow up with your customers regarding payment terms and due dates. Look for any overdue payments and reach out to those customers right away. You’ll also want to check for any fraudulent activity like unauthorized charges.

For small businesses, reconciling invoices manually can be time-consuming and error-prone. Using accounting software or invoice reconciliation software streamlines the reconciliation procedure. These solutions automatically match up invoices, purchase orders, and payments—alerting you to any issues. They provide reports on open invoices, overdue payments, and cash flow to give you a real-time view of your financial health.

Types of invoice reconciliation

There are several common types of invoice reconciliation used by small businesses. The approach you choose depends on your specific needs and accounting processes.

Two-way matching

This is the most basic type of reconciliation. It involves matching the details of a supplier invoice to your corresponding purchase order. This ensures you’re only paying for what you actually ordered.

Three-way matching

This adds another layer of verification by also matching the details of the supplier invoice and purchase order to the details of the goods or services that were actually received. This helps prevent paying for items that were never delivered.

Four-way matching

The most comprehensive approach, four-way matching, also verifies that the details on the supplier invoice, purchase order, and goods received match your accounting records. This double-checks that the invoice is recorded properly in your books before payment is made.

Vendor statement reconciliation

This involves reconciling the details listed on a supplier’s monthly or quarterly statement to ensure your records of invoices paid, open invoices, and overdue payments match the supplier’s records. This helps identify any discrepancies early on.

Credit card reconciliation

If you make business purchases with a company credit card, it’s important to reconcile the credit card statement each month to match transactions to supplier invoices, receipts, and your accounting records. This ensures no fraudulent activity has occurred and all expenses are properly accounted for.

The approach you choose will depend on your business’s needs and accounting processes. For many small businesses, a manual combination of two-way and three-way matching, along with monthly vendor statements and credit card reconciliation, provides sufficient controls without significant time demands. However, as your business grows, invoice reconciliation software can help automate and streamline the entire reconciliation procedure.

Invoice reconciliation best practices

Reconciling invoices regularly is one of the most important things you can do as a small business owner to maintain accurate accounting records and healthy cash flow. Follow these best practices to streamline your reconciliation procedure

Reconcile frequently

Reconcile invoices often, at least once a month. The more often you reconcile, the less work you’ll have to do at once and the faster you can catch any discrepancies or fraudulent activity. Waiting too long can lead to issues like overdue payments, inaccurate book entries, and cash flow problems.

Centralize your records

Maintain organized records of all supplier invoices, purchase orders, and payments. Having everything in one place, whether digital or physical files, makes the reconciliation process much easier. You can quickly find invoice numbers, payment terms, and other details needed to match invoices to payments and accounting entries.

Automate reconciliation processes

Use accounting software to automate as much of the process as possible. Many programs offer invoice matching and reconciliation features that can save you time. They can alert you to unmatched invoices, duplicate payments, or invoices lacking a purchase order. You can also set tolerance levels for small discrepancies.

Adopt three-way matching

Perform three-way matching of invoices, purchase orders, and payments. This helps ensure you’re only paying for what you actually ordered and received. It’s one of the best ways to prevent fraud and catch errors.

Connect your purchasing process

The details from purchase orders and receiving documents should match the information on invoices before payments are made. This end-to-end process integration simplifies reconciliation and reduces the chances of oversights.

Invoice reconciliation is the foundation of good financial health

In summary, reconciling invoices is vital for small businesses to manage finances, avoid issues, deter fraud, and gain financial insight. While it may seem tedious, the benefits to your business are well worth the effort. Automating the process through accounting software can save you time while still reaping the rewards.